Effective marketing plays a crucial role in attracting buyers and investors to commercial properties. An Offering Memorandum is more than just a document—it’s a powerful tool that showcases a property’s full potential. Having worked extensively with commercial real estate marketing materials, I’ve learned that every property type demands a customized approach. This guide explores how to tailor an Offering Memorandum for different property types while incorporating essential elements such as real estate flyer design, aerial mapping, and targeted marketing strategies.

Understanding the Role of an Offering Memorandum

An Offering Memorandum (OM) serves as a key document in commercial real estate transactions, particularly in investment property sales. Unlike a standard marketing brochure, an OM provides a detailed analysis, covering location, financials, investment potential, and risk factors. Investors rely on this document to make informed decisions, which is why a well-structured OM can significantly impact the success of a property sale.

Offering memorandum for Different Property Types

Office Buildings: Stability and Professional Appeal

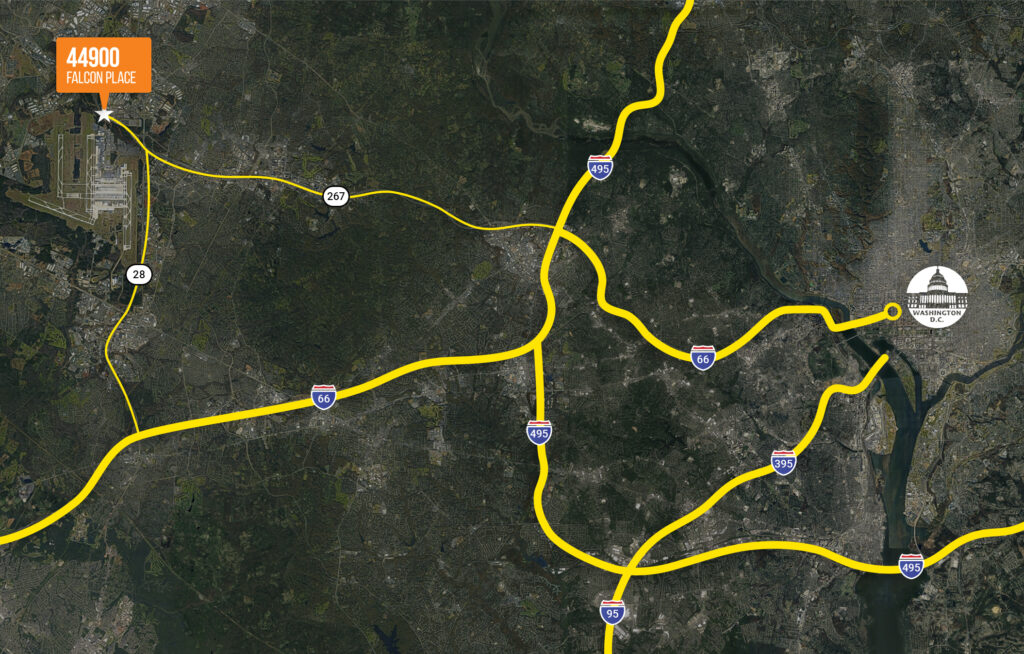

When marketing office buildings, investors focus on tenant stability, lease agreements, and location advantages. A professional OM should reflect these priorities by maintaining a clean, structured layout. Aerial maps provide valuable context by highlighting nearby businesses, transportation access, and infrastructure. Additionally, including tenant profiles and lease summaries gives insight into rental income, lease expirations, and long-term occupancy trends.

Retail Properties: Visibility and Consumer Demand

Retail properties require an OM that emphasizes foot traffic, visibility, and sales potential. A well-designed real estate flyer enhances the property’s appeal by showcasing storefront images and nearby businesses. Investors need to understand consumer demographics, purchasing power, and competitive market analysis. Highlighting these factors helps create a strong case for why the property is an attractive investment.

Multifamily Properties: Cash Flow and Long-Term Returns

For multifamily investments, the focus shifts to occupancy rates, rental income, and financial projections. Investors want to see strong tenant retention and future income potential. Including rent roll analysis, financial forecasts, and lease-up strategies reassures investors of stable cash flow. Lifestyle images of amenities, communal spaces, and unit interiors help create a more compelling presentation.

Industrial and Warehouse Properties: Logistics and Expansion Potential

Investors interested in warehouse and industrial properties prioritize factors such as logistics, accessibility, and zoning laws. A well-structured OM should include site plans, aerial maps, and detailed building specifications. Information on proximity to highways, rail networks, and ports can significantly impact an investor’s decision. Additionally, future expansion opportunities and zoning details add value to the presentation.

Hospitality Properties: Guest Experience and Revenue Growth

For hotels and resorts, the OM should focus on revenue potential, occupancy rates, and customer experience. High-quality property photos showcasing guest rooms, amenities, and surroundings help capture attention. Key financial data, such as ADR, RevPAR, and occupancy trends, reinforces the property’s profitability. If the property is part of a franchise, highlighting its brand affiliation and management agreements strengthens its investment appeal.

Aerial Maps and Visual Enhancements in Real Estate Marketing

Visuals play a critical role in enhancing an OM’s effectiveness. Aerial mapping helps investors visualize property locations, access points, and surrounding infrastructure. These maps are particularly beneficial for large commercial developments, industrial sites, and retail centers. Including infographics, charts, and high-resolution images ensures that complex information is easy to digest and understand.

The Importance of Real Estate Lender Marketing Materials

A well-crafted OM for lenders is just as essential as one for investors. When securing funding, loan feasibility, risk analysis, and financial projections take center stage. Lender marketing materials should outline debt-service coverage ratios (DSCR), loan-to-value (LTV) ratios, and risk mitigation strategies. The goal is to instill confidence in lenders by demonstrating the property’s financial viability and long-term stability.

Navigating Regional Commercial Real Estate Markets

Understanding local market conditions is critical, particularly in emerging markets. Investors need insights into economic growth trends, regulatory considerations, and investment incentives. For instance, in regions like Bangladesh, where the real estate market is evolving, highlighting legal frameworks, property acquisition processes, and local development trends can provide significant value. Moreover, multilingual OMs can help widen accessibility, ensuring that materials are available in both English and Bengali to reach a broader audience.

Conclusion: Elevating Commercial Real Estate Marketing

A customized Offering Memorandum is essential in making a property stand out. By tailoring the OM to specific property types, investor priorities, and market conditions, sellers can maximize engagement and build stronger investor relationships. Throughout my experience in real estate syndication, aerial mapping, and marketing design, I’ve seen firsthand how the right approach makes all the difference. Whether selling an office tower, a retail center, or a multifamily development, investing in high-quality marketing materials and OM design can significantly enhance property visibility and buyer interest. In a competitive market, standing out is not just an advantage—it’s a necessity.