If you’ve ever been handed a thick packet labeled “Offering Memorandums” (often called a CRE Offering Memorandums), you know it can sometimes feel like a mini novel about a commercial real estate investment. But when done right, it doesn’t have to be dry or overwhelming. Think of it as your property’s resume, showcasing the best features and painting a clear, appealing picture for potential investors. Below are the must-have sections every offering memorandums needs, plus a few design tips to keep readers engaged.

1. Executive Summary

This is your elevator pitch. It sums up the property’s unique selling points, financial expectations, and why investors should be excited.

What to Highlight:

Quick stats on location and property size

A snapshot of projected returns or cap rate

One or two compelling reasons the property stands out

Make It Engaging:

Use plain language. Pretend you’re explaining the opportunity to a friend over coffee. One or two paragraphs should pique curiosity and encourage a deeper dive.

2. Property Description

This is the heart and soul of your CRE Offering Memorandums. Investors want the who, what, where, and when of the building or land.

What to Highlight:

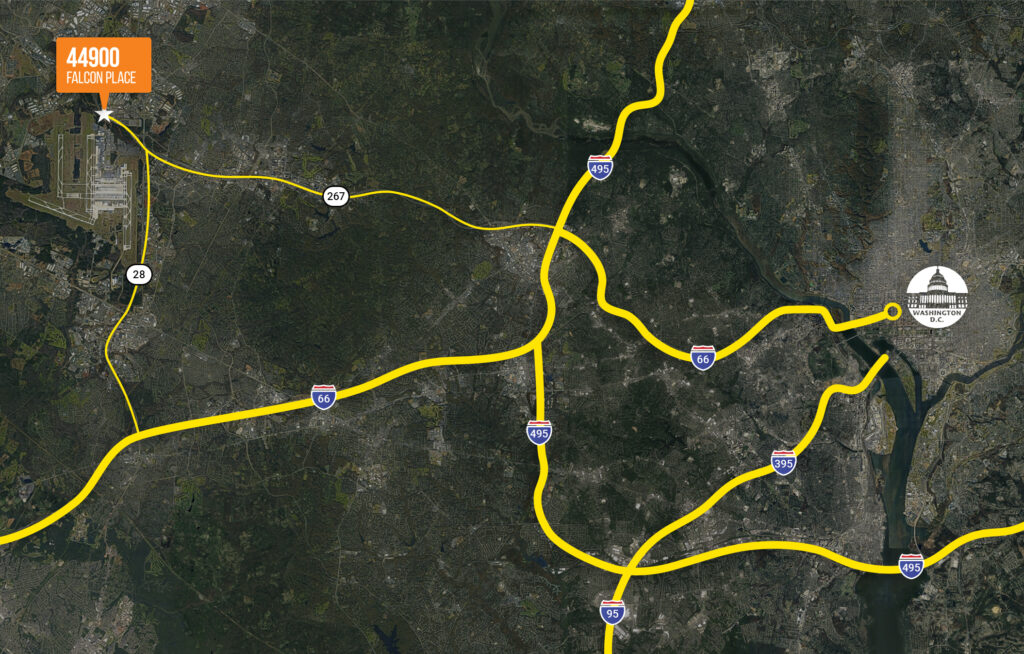

Location details: neighborhood vibe, nearby amenities, major highways

Building specs: year built, square footage, layout, special features

Visual aids: floor plans, photos, and maybe a quick property map

Make It Engaging:

Tell a story. Maybe the building has a historic background or modern, energy-efficient upgrades. A quick anecdote can add personality to the space.

3. Market Analysis

A snapshot of the economic and demographic factors influencing the property’s performance.

What to Highlight:

Local economic drivers: major employers, upcoming developments, average household income

Rent comps: occupancy rates, lease rates, and other relevant data from similar properties

Growth trends: new transportation projects, zoning updates, or community initiatives

Make It Engaging:

Charts, graphs, and infographics can bring market data to life. Visual representation often makes numbers more accessible.

4. Financials

This is where you present the numbers. Investors typically jump to this section first or second, depending on how compelling your executive summary is.

What to Highlight:

Historical performance: rental income, net operating income, and expenses

Pro forma projections: forward-looking assumptions on income, rent growth, and vacancy rates

Financing details: loan terms, equity splits, or planned refinancing milestones

Make It Engaging:

Be transparent about how you arrived at your assumptions. If you forecast a certain rent increase, offer a short rationale to build trust with investors.

5. Terms and Deal Structure

Clarity on how the deal works. This part sets expectations for pricing, timelines, and profit distribution.

Asking price or equity raise target

Proposed hold period or exit strategies

Partnership splits: preferred returns, promote structures, or waterfall distribution models

Make It Engaging:

Keep language straightforward. Jargon can alienate new investors, so aim for clarity over complexity.

Design Tips

Captivating cover page: A clean, modern cover with a strong property image can grab attention right away.

Consistent layout and branding: Limit yourself to one or two fonts and a cohesive color palette for a professional look.

Ample white space: Avoid clutter. Give text and visuals room to breathe for easier reading.

High-resolution images and infographics: Crisp visuals and data representations help convey professionalism.

Logical flow: Arrange sections in a way that naturally tells the property’s story, from broad overview to detailed financials.

If you need help combining compelling content with eye-catching design, visit OM Design Agency. You can also browse their portfolio for ideas on how to elevate your offering memorandum presentation.