Imagine you own a commercial property—a retail center, an office building, or maybe a multifamily complex. You’ve been managing it for a few years now, and you’re starting to wonder: What’s it worth? Maybe you’re thinking about selling. Possibly you’re considering refinancing. Or maybe you’re just curious. Whatever the reason, you need a realistic estimate of your property’s value. But here’s the thing—you’re not ready to shell out big bucks for a formal appraisal just yet. This is where a Broker Opinion of Value, or BOV, comes into play. As a commercial real estate designer, copywriter, and instructor, I’ve seen firsthand how a good BOV can help property owners make smarter decisions. It’s often the first step in selling a property, preparing an offering memorandum, or kicking off a real estate marketing campaign.

So, What Exactly is a Broker Opinion of Value (BOV)?

A Broker Opinion of Value is pretty much what it sounds like: a licensed commercial real estate broker’s professional opinion of what your property might sell for in the current market. It’s based on a mix of local knowledge, recent comparable sales, market conditions, and a healthy dose of professional experience.

Think of it as a bridge between guesswork and a formal appraisal. It’s not legally binding, and it won’t satisfy a lender for financing purposes. But it’s fast, usually free (or low-cost), and can offer valuable insights. In many cases, brokers offer BOVs to show their expertise and start building trust with potential clients.

Why Does a Broker Opinion of Value (BOV) Matter So Much?

Let’s say you’re planning to sell your property. Naturally, you want top dollar. But you also need to be realistic. Price it too high, and it could sit on the market. Price it too low, and you might leave money on the table. A BOV helps you find that sweet spot.

A well-prepared Broker Opinion of Value gives you:

- Market Insight: You’ll understand where your property fits in the local landscape.

- A Pricing Strategy: A realistic number helps guide negotiations.

- A Jumpstart on Marketing: Many brokers use BOV to prepare offering memorandums, which they use to pitch properties to investors and buyers.

What’s Actually Inside a Broker Opinion of Value (BOV)?

You might be wondering what makes up a BOV. While every broker has their own style, most reports include:

1. Property Summary

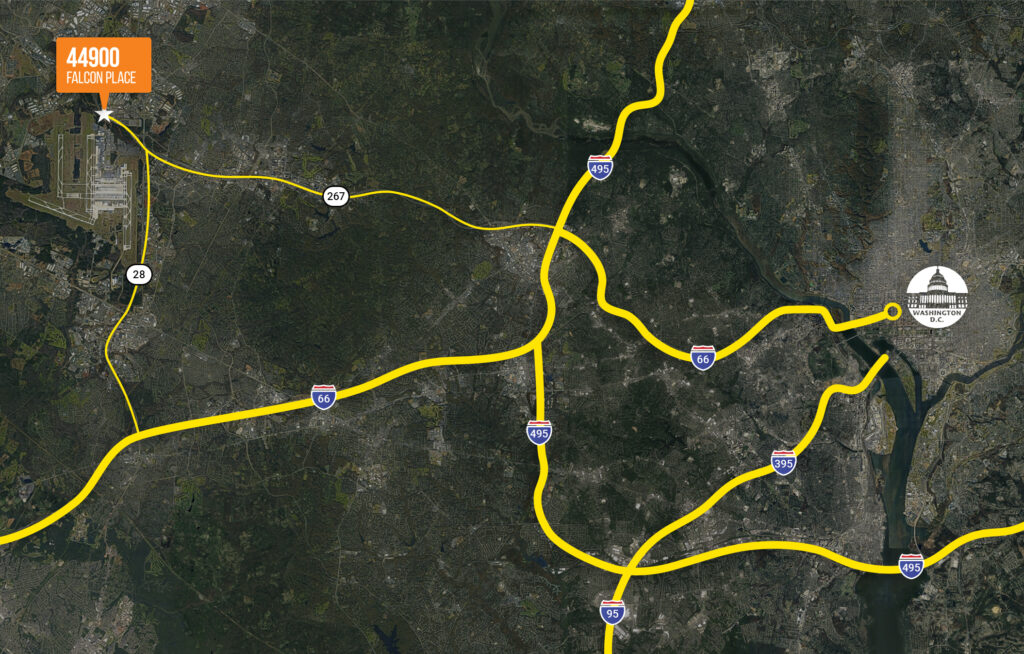

This covers the basics—location, building size, land area, age, property type, and condition. It might include photos or a site map, giving buyers a solid snapshot.

2. Market Overview

This section explains what’s happening in your market. Are rents rising? Is vacancy high? How do similar properties perform? It sets the stage.

3. Comparable Sales and Lease Data

Here’s where brokers show their work. They list similar properties that have recently sold or leased, highlighting differences that might affect value—like location, condition, and tenancy.

4. Financial Review

If your property generates income (think apartments or office leases), the broker will analyze rent rolls, operating expenses, and lease terms. This review often includes a look at net operating income (NOI) and cap rates.

5. Valuation Conclusion

Finally, the broker provides their opinion of value—sometimes as a range, sometimes a single number. They’ll usually suggest an asking price if you plan to list.

BOV vs. Appraisal: What’s the Difference?

People typically confuse Broker Opinions of Value with appraisals, but they’re different animals.

- A BOV is informal. It’s an educated guess based on experience and comps.

- An Appraisal is formal. It’s a detailed, regulated process performed by a licensed appraiser, often required by lenders.

Appraisals can cost thousands of dollars and take weeks. A BOV, on the other hand, is faster, more flexible, and typically free.

How Does a Broker Opinion of Value (BOV) Fit Into Your Real Estate Marketing Strategy?

Here’s where things get interesting. A Broker Opinion of Value isn’t just for your own knowledge—it’s a powerful marketing tool. Once you have a BOV, your broker can use it to create an offering memorandum, which presents your property to investors. The BOV sets expectations and helps shape the story you tell in your real estate marketing materials.

For example, if the BOV highlights a strong tenant roster and low vacancy rates, your flyers, brochures, and online listings should focus on cash flow stability. If the BOV shows upside potential—maybe rents are below market—your marketing can emphasize future returns.

When Should You Ask for a Broker Opinion of Value (BOV)?

There are plenty of times a BOV makes sense:

- Before Selling: Know your value before listing.

- Before Refinancing: Gauge whether refinancing makes sense.

- Before Redevelopment: Understand your starting point before making improvements.

- For Portfolio Valuation: Get a quick, rough estimate of your holdings.

I always recommend getting a BOV if you’re creating a new offering memorandum or launching a new real estate marketing campaign. It sets the stage for everything that follows.

Why You Need a BOV

A Broker Opinion of Value may not have the official stamp of an appraisal, but it’s one of the most useful tools in commercial real estate. It’s fast, insightful, and often the first step toward a successful sale, lease, or refinance.

Whether you’re an owner weighing options or a broker building a client relationship, a solid BOV opens doors and starts important conversations. And if you need an offering memorandum or real estate marketing materials that match your property’s value, you know where to find me.

At OM Design Agency, we design professional offering memorandums, pitch decks, and aerial maps that bring your property’s story to life—and make buyers pay attention.

Want to talk about your next project? Reach out today!